Posts

Can Account Planners Reclaim Seats at the Strategy High Table?

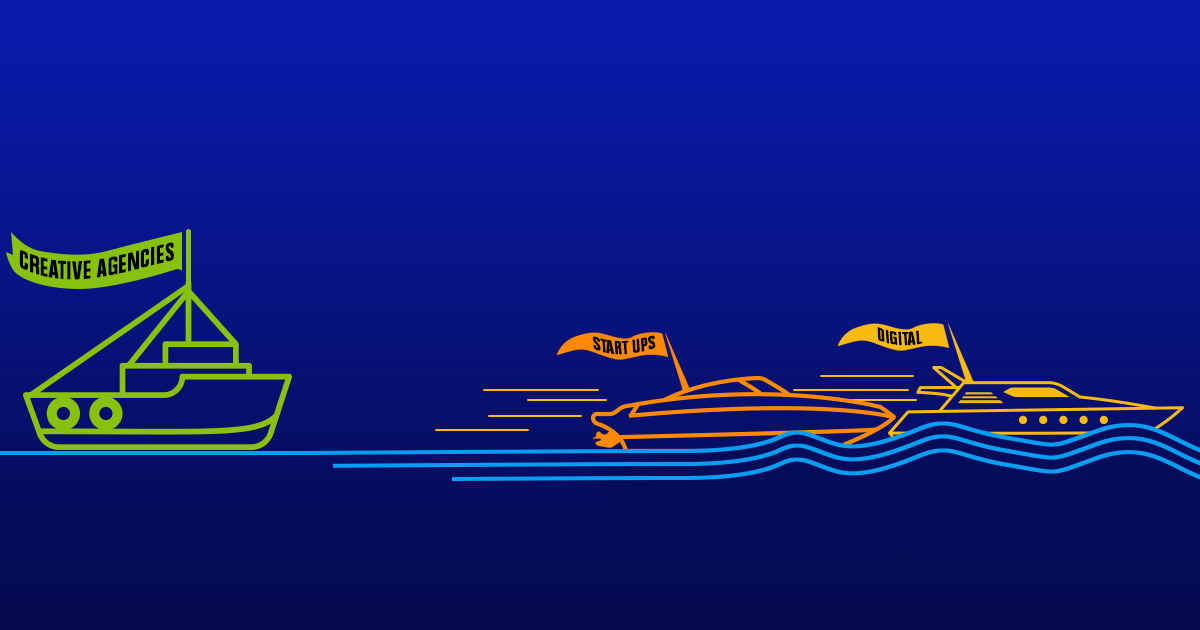

The traditional creative agency model, with the 30-sec TVC as its fulcrum, is under existential stress.

Are agency account planners alive to new opportunities for their agencies to re-take their place on the strategy high table?

A 2016 article from McKinsey Global Institute entitled “New insights for new growth:

What it takes to understand your customers today”is a must-read for all ad agency folks who are wondering why blue-chip clients are cutting back on traditional media advertising. The question is: what are clients doing with the budgets they are taking away from the 30-second TVC?

Part of the answer lies in well-known disruptions in the advertising and market research industries. A large part, but only a part.

Too well known to go into in detail here are the disruptive creative and targeting opportunities opened up by digital media. Think of it as customised advertising on turbo-charge.

Industry trends reflect this. Digital agencies in India will grab billings of Rs 11,600 crores in 2018, growing rapidly at 25% compared to last year. Nimble start-ups will take a larger share of this every year. Consumers are shifting attention away from TV to online media – with 80% of digital media consumption over smartphones, a growing chunk being video content. Tellingly, India will see 200 million smartphones sold in 2018 alone!

Digital ad technology sees new innovations almost every single day … new methods of media buying and content delivery are constantly being offered. Ever more affordable DIY (Do-It-Yourself) software tools are enabling marketers to take many ad agency functions in-house, including the creation of centralised “content hubs” that can serve global brands operating in dozens of countries. AI and NLP (Natural Language Processing) advances are enabling real-time qualitative research at scale, disrupting traditional research agency models. All of these are taking budgets away from traditional ad and market research agencies.

Let’s say ad agency folks are aware of all this. But are they aware of the disruptions that their clients themselves are facing? Are account planners aware of what the big guns are doing to mount counter-disruptions?

Globally, Unilever and P&G are moving fast on consumer co-created brands with high revenue potential using online communities. Philips is focussing on city-level growth with hyper-local big data analysis. Amazon attributes more than one third of its revenues through cross-selling by building individual relationships with customers. A pharma major used digitized daily diaries to unlock a potential $ 100 million revenue in self-administered medications. Netflix is using subscribers’ viewing behaviour to create ideas for block-buster serials. Nestle has invested resources in centralised content hubs to service global brands. Nivea taps into social media listening to develop completely new product lines. The list goes on.

Another McKinsey analysis of the food and beverage market from 2013–17 reveals that the top 25 manufacturers are responsible for 59 percent of sales but only 2 percent of category growth. Conversely, 44 percent of category growth has come from the next 400 manufacturers.

There is a prevailing myth that consumer companies need to do a few big launches a year. Even if that were once true, it no longer is.

McKinsey found that during 2013-17, large CPGs in packaged foods launched 85 brands, of which only 20 were alive after 4 years. In the same period, small incumbents and new start-ups launched 1,001 brands, of which only 241 were alive in 2017. So, while the success rate for both classes of firms was 25%, that still left 241 new brands for the major players to compete with.

In a disruptive environment, large CPG firms are thinking and acting like venture investors in two key ways:

- Constantly floating new brands (not incremental improvements on existing ones) with the expectation that three in four brands may not last beyond 4 years

- Recognising that it’s not first-to-market but first-to-scale brands that win in the long run.

The existential stress that large CPG brands face is something that very few agency folks are thinking about. They face disruption from hundreds of small-incumbent and new start-up brands chipping away at dozens of niche product segments and local consumer segments. Digital technology … and the exploding choices and consumer touchpoints it provides … is keeping brand managers and marketing directors awake at night.

How can creative agencies help clients counter-disrupt? It’s a wake-up call for creative agencies.

Leave a Reply